Great article from John Kemp

U.S. gas prices slump to maximise power burn: Kemp - Reuters News

10-Feb-2023 15:41:39

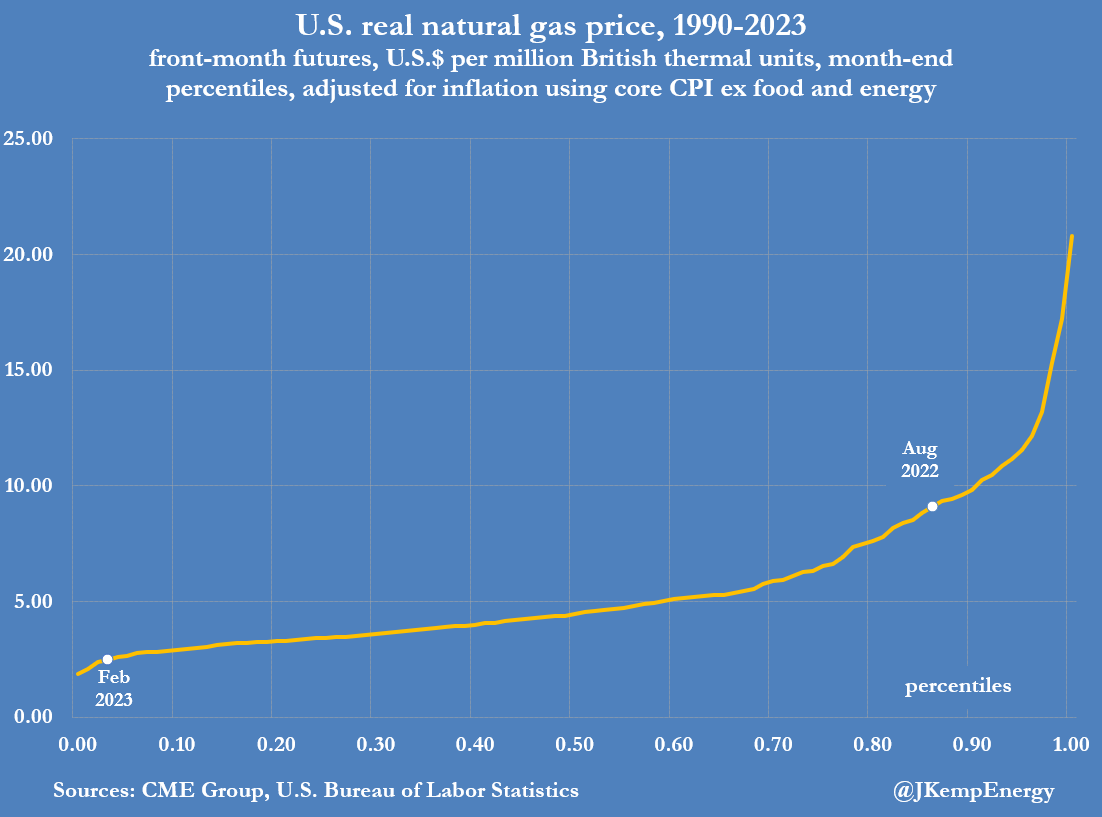

LONDON, February 10 (Reuters) - U.S. gas prices remain stuck at some of the lowest levels for 30 years (after adjusting for inflation) in a signal to dial back new well drilling and maximise combustion by power producers.

Front-month futures closed at $2.45 per million British thermal units on February 9, in only the second percentile for all months since 1990, after allowing for the increase in core consumer prices.

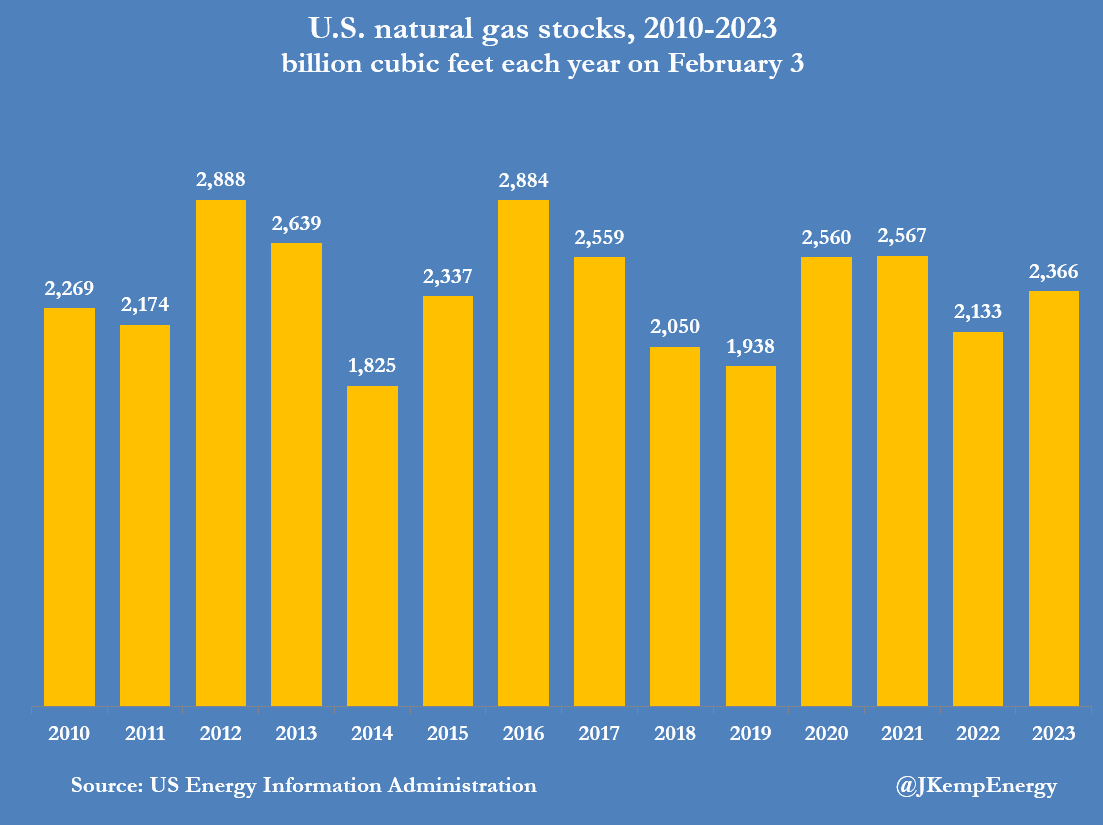

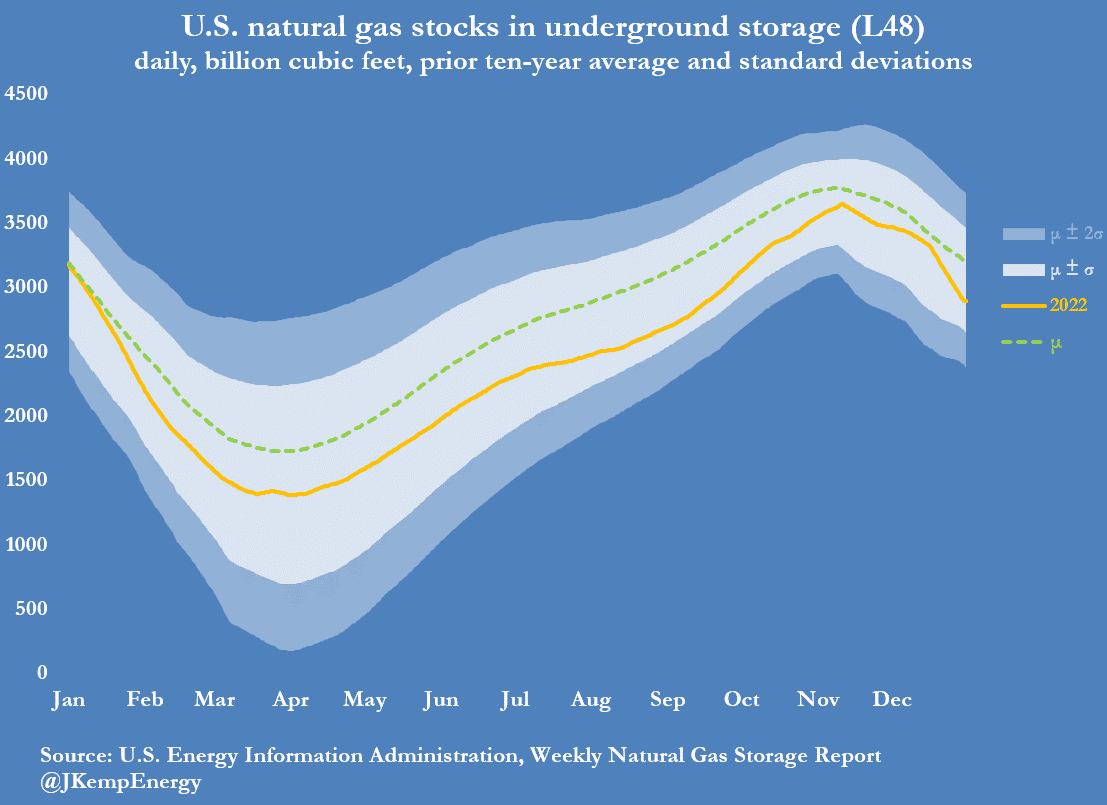

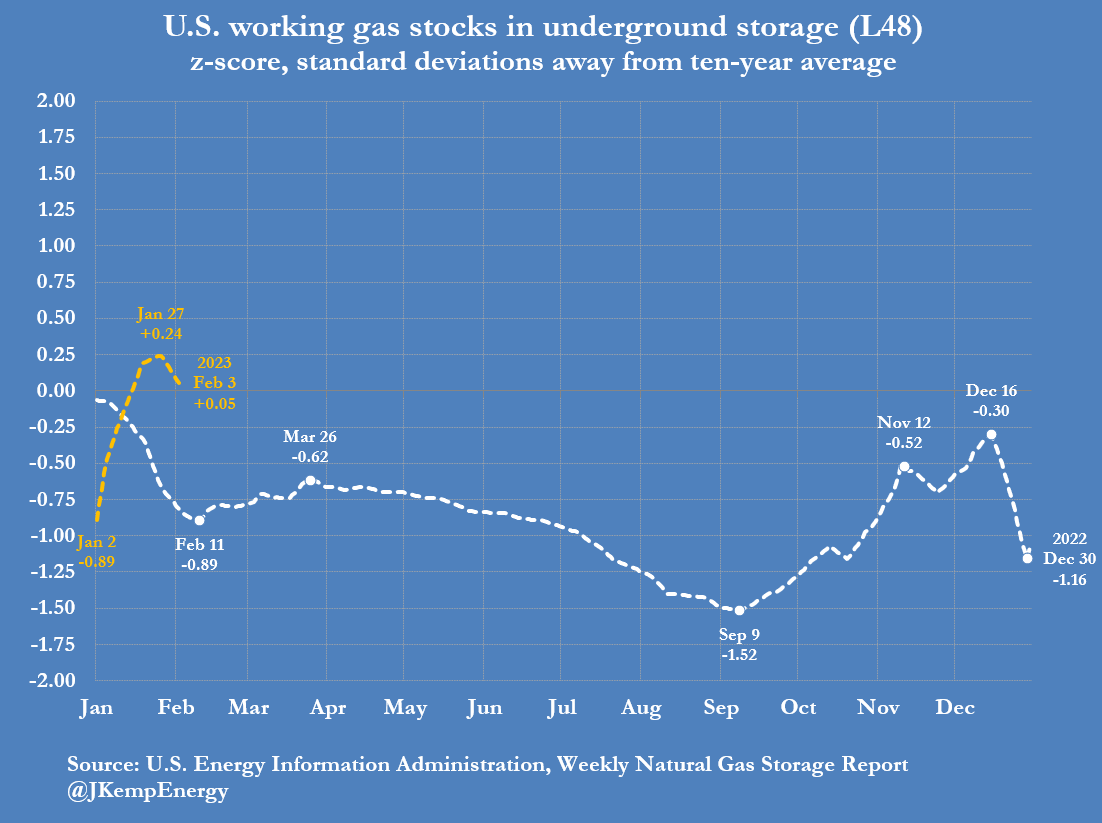

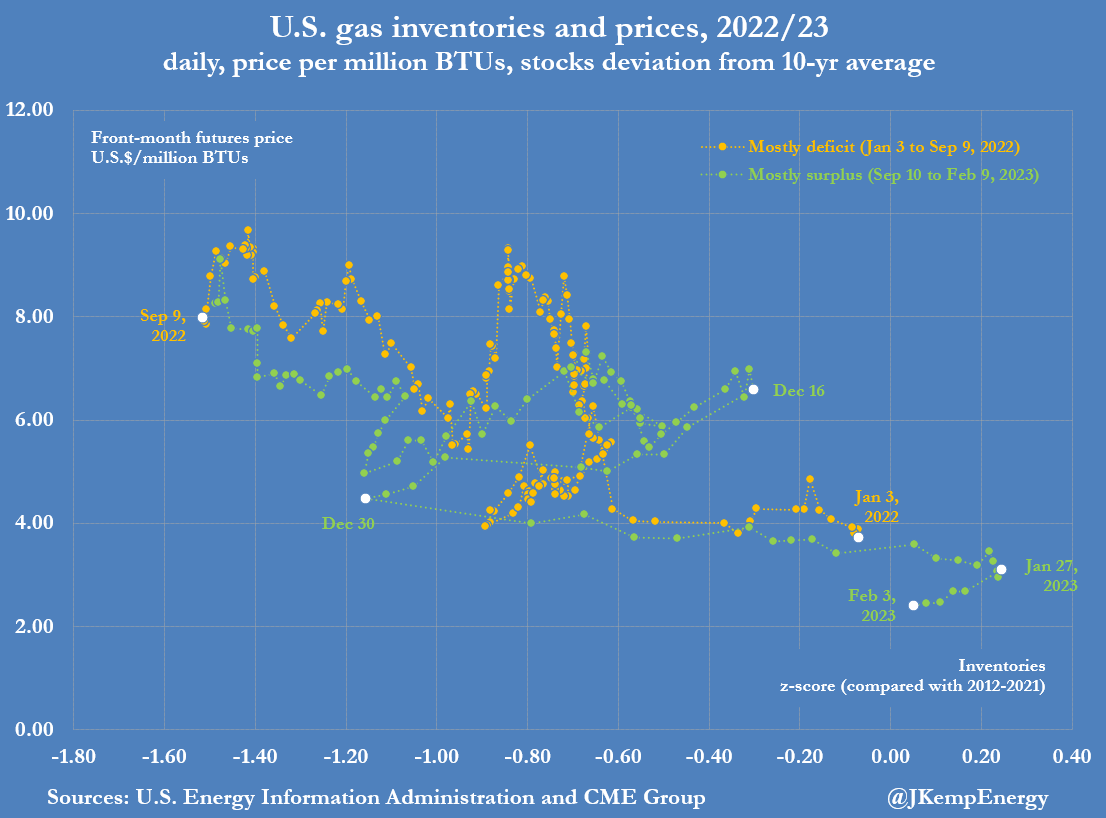

Working inventories in underground storage were +17 billion cubic feet (+1% or +0.05 standard deviations) above the prior ten-year average on February 3.

But that was a massive turn around from a deficit of -427 billion cubic feet (-13% or -1.52 standard deviations) as recently as September 9.

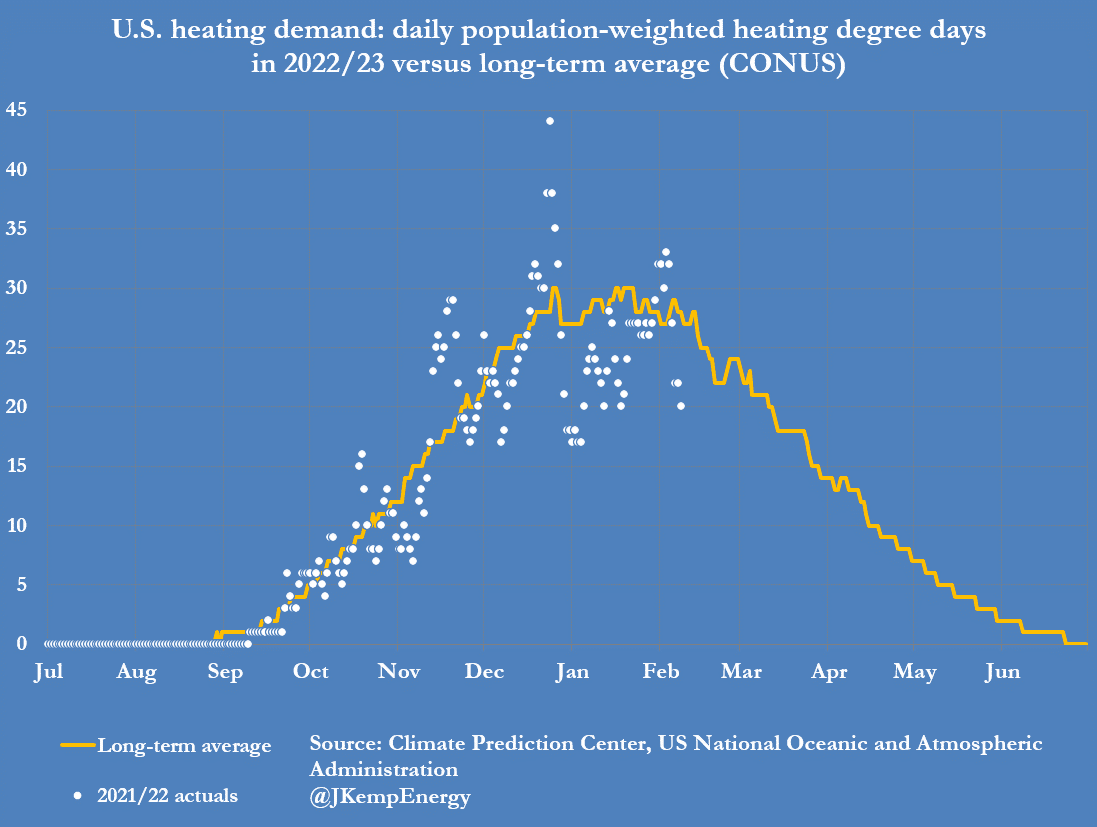

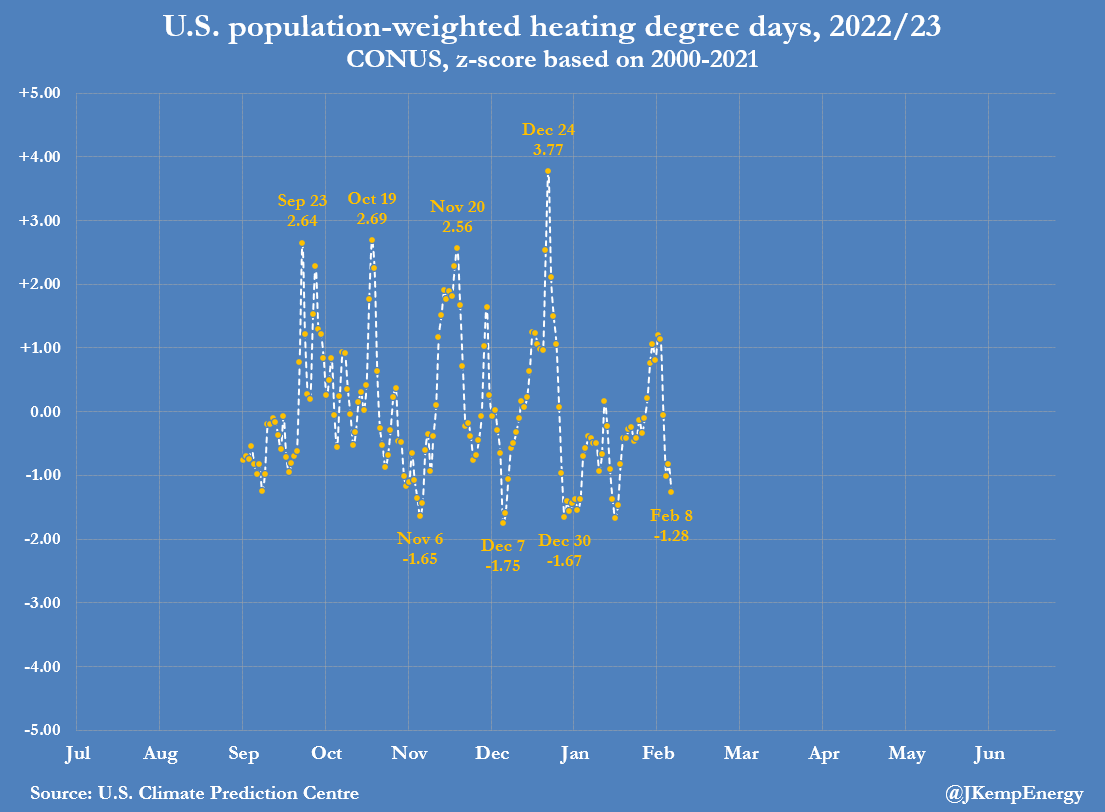

Mild weather has played a relatively small role in erasing the earlier deficit and transforming it into a large incipient surplus.

The number of heating degree days across the Lower 48 states so far this winter has been only 5% below the long-term average.

More important has been loss of exports following the explosion at Freeport LNG’s terminal and reduced consumption stemming from high prices through much of 2022.

Chartbook: U.S. gas prices and inventories

Freeport’s eventual reopening should provide an outlet for some excess inventory, but with stocks in Europe also very full, exporters will have to compete for price-sensitive customers in Asia.

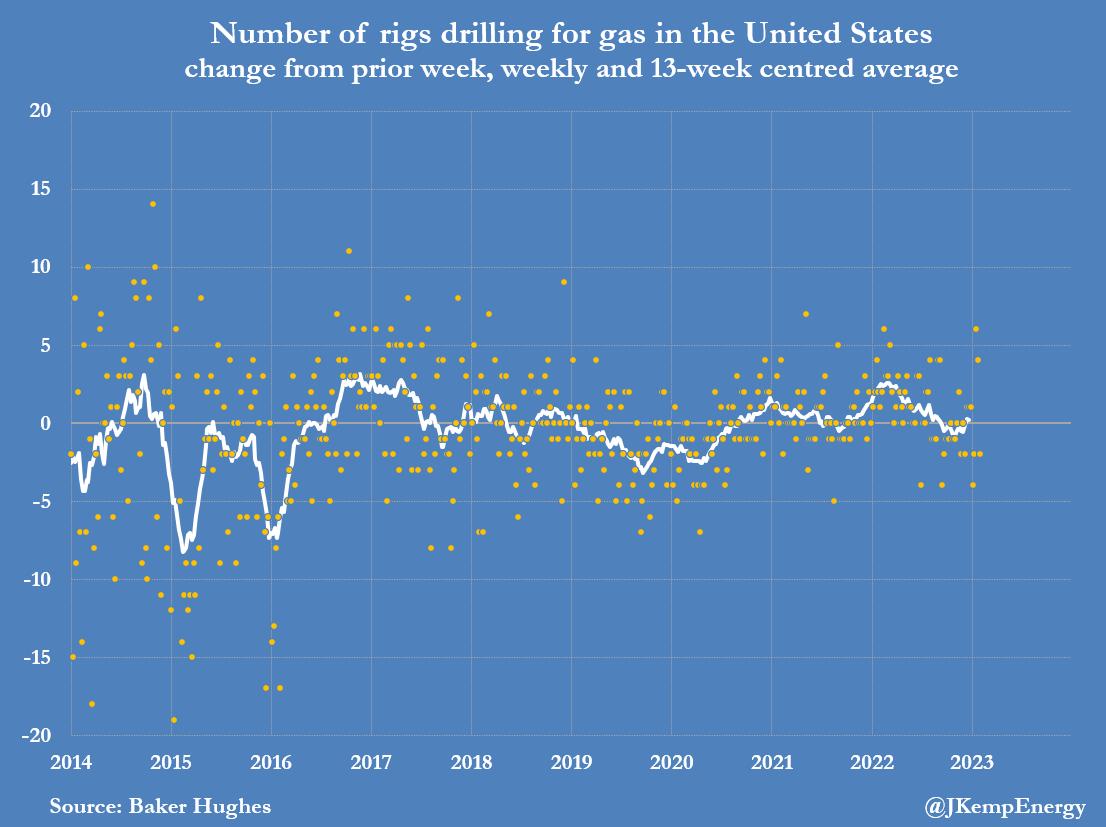

Slumping futures prices will discourage drilling and incentivise electricity generators to run their gas-fired units for more hours at the expense of coal.

The number of rigs drilling for gas has been essentially unchanged since the start of September - after increasing by more than 50 (+50%) in the first eight months of 2022.

Discounted futures prices will also boost combustion from the power sector, helping limit the accumulation of inventories this summer.

The summer-winter calendar spread between July 2023 and January 2024 has slumped into a contango of more than $1.10 per million British thermal units from a backwardation of more than 50 cents in August 2022.

Gas prices are now trading below the cost of coal, once the superior efficiency of gas-fired units is taken into account, which will encourage maximum gas burn this summer.

Related columns:

- Europe’s gas supply stabilises after colder weather (Reuters, February 3, 2023)

- U.S. gas prices slump on production surplus (Reuters, January 12, 2023)

(Editing by Mark Potter)

IF YOU know anyone else who might like to receive best in energy and my research notes, they can add their emails to the circulation list using this link: [http://eepurl.com/dxTcl1

John](http://eepurl.com/dxTcl1John) Kemp

Senior Market Analyst

Twitter: @JKempEnergy

Phone: +44 7789 483 325

5 Canada Square

Canary Wharf

LONDON

E14 5AQ

UNITED KINGDOM

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list